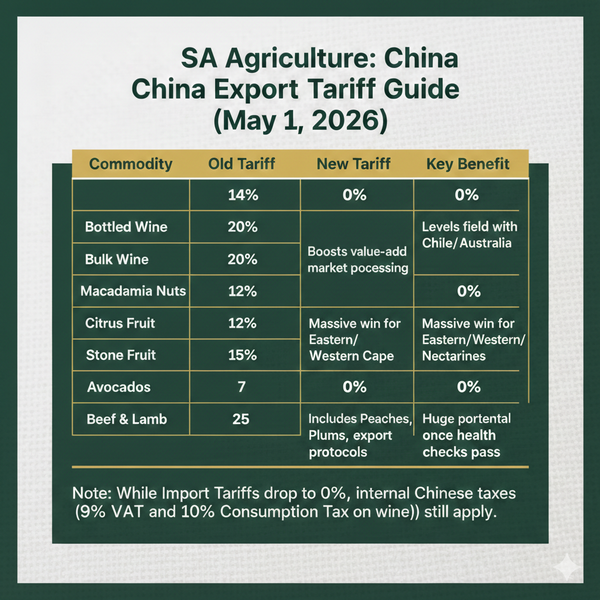

For years, South African producers have eyed the massive Chinese market with a mix of ambition and frustration. While “Least Developed Countries” (LDCs) in Africa enjoyed duty-free access, South Africa’s status as a middle-income economy meant our premium produce often landed on Chinese shelves with a 10% to 25% price penalty.

That changes on 1 May 2026. Following the landmark signing of the China-Africa Economic Partnership Agreement (CAEPA) in February, China will officially remove import tariffs on 100% of tariff lines for South Africa. For the agricultural sector, this isn’t just a policy tweak—it is a competitive reset.

The Winners: From Double Digits to Zero

The most immediate impact will be felt in high-value export sectors. By removing the “entry fee” at the border, South African products will finally compete on an equal footing with nations like Chile and Australia, who have long enjoyed free-trade status with Beijing.

What You Still Have to Pay

It is crucial for producers to understand that Zero Tariff does not mean Zero Tax. While the import duty (the border tax) is being removed, internal Chinese taxes still apply at the port of entry:

Value Added Tax (VAT): Most agricultural products in China are subject to a 9% VAT (recently standardized for necessity goods).

Consumption Tax: Specific goods, such as wine, still carry a 10% Consumption Tax.

Logistics & Levies: Standard port handling fees, customs clearance costs, and local distribution levies remain the responsibility of the importer/exporter.

The “Hidden Barrier”: It’s Not Just About Price

While the 0% tariff makes our prices competitive, it does not bypass Sanitary and Phytosanitary (SPS) hurdles. China’s “Green Channel” initiative aims to speed up inspections, but strict health protocols remain the primary gatekeeper.

Currently, the Department of Agriculture is finalizing protocols for Cherries and Blueberries. Until these specific “health passports” are signed, even a 0% tariff won’t get the fruit past the port. Producers must ensure their packhouses meet the rigorous “cold-chain” and pest-management standards required by Chinese customs (GACC).

Looking Ahead

An “Early Harvest Agreement” is expected by the end of March 2026, which will provide the final technical HS Codes for every agricultural product. For the South African farmer, the message is clear: the financial barrier is falling. Now, the challenge is meeting the volume and quality demands of the world’s most populous consumer base.