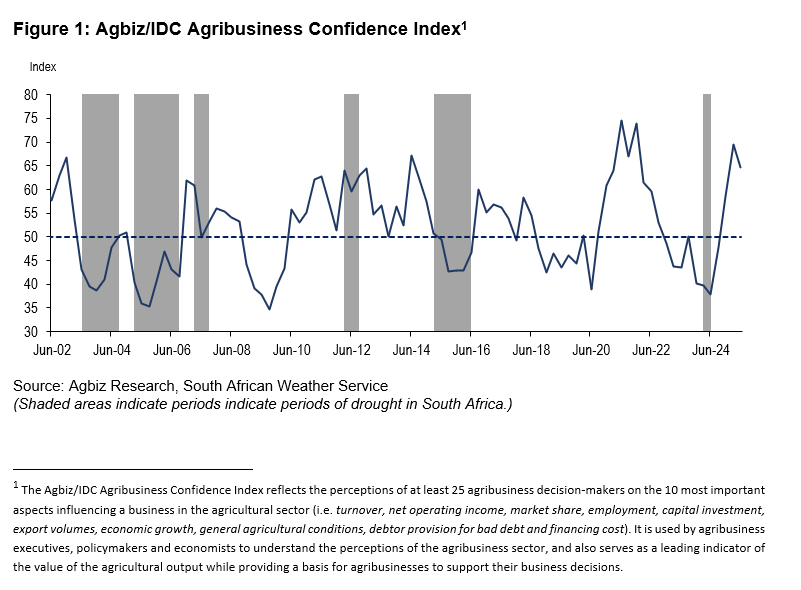

After a strong start to 2025, South Africa’s agribusiness sector experienced a slight dip in confidence in the second quarter. According to Wandile Sihlobo, Chief Economist at the Agricultural Business Chamber of South Africa (Agbiz), the Agbiz/IDC Agribusiness Confidence Index (ACI) fell by 5 points to 65 in Q2 2025. While this marks a decline from the previous quarter, the index remains comfortably above the neutral 50-point threshold, signalling that the sector remains broadly optimistic about business conditions.

This moderation in confidence comes against the backdrop of a challenging global trade environment, ongoing geopolitical tensions, and domestic concerns, particularly around animal disease outbreaks like foot-and-mouth disease. Despite these headwinds, positive developments such as good summer rainfall and improvements at the country’s ports have helped support agribusiness activity and maintain overall optimism.

The ACI survey, which was conducted in early June, reflects the views of agribusinesses operating across South Africa’s diverse agricultural subsectors.

Subindices Show Mixed Performance

The ACI consists of ten subindices, capturing different dimensions of agribusiness activity. In Q2 2025, six of these subindices declined, while the remaining four held steady.

Subindices that Declined

Turnover and Net Operating Income: Both indicators declined by 5 points, standing at 55 and 65 respectively. The decline in turnover was largely driven by weaker confidence among red meat producers, who remain affected by animal health issues.

- Export Sentiment: Dropped sharply by 40 points to 60. Despite this significant fall, export confidence remains relatively strong, supported by robust export earnings of US$3.36 billion in Q1 2025, which were 10% higher than a year earlier.

- General Economic Conditions: Declined by 15 points to 50, highlighting concerns over slowing growth prospects both domestically and globally.

- Market Share: Fell modestly by 5 points to 65, with most businesses reporting largely unchanged views compared to the previous quarter.

Subindices that Remained Steady

- Employment: Remained unchanged at 55, underpinned by strong production conditions in field crops and horticulture.

- Capital Investment: Stayed steady at 75, reflecting solid investment activity, as shown by continued strong tractor and combine harvester sales.

- General Agricultural Conditions: Held firm at a high 80 points, benefiting from the favourable La Niña rainfall during the 2024/25 summer season.

Financial Indicators

Unlike the other subindices, changes in financing costs and bad debt provisions are interpreted inversely. In Q2 2025, financing costs unexpectedly rose by 10 points to 85, despite a general easing of interest rates, suggesting some financial strain in certain areas. Meanwhile, the bad debt provision remained stable at 50, indicating that while some farmers continue to face financial pressures, conditions have not deteriorated further.

Looking Ahead

Despite the mild decline in the index, the overall outlook for South African agribusiness remains positive. However, as Sihlobo highlights, the sector’s strong reliance on export markets makes it vulnerable to global developments. Expanding access to markets such as China, India, Saudi Arabia, and Egypt, while maintaining existing trade relationships in the EU, UK, Africa, Asia, Middle East, and Americas, remains essential for long-term growth.

Equally important is the need for ongoing collaboration between government and industry to strengthen biosecurity systems, improve infrastructure and municipal management, and fully implement the Agriculture and Agro-processing Master Plan. These steps will help ensure that South Africa’s agricultural sector remains resilient, competitive, and well-positioned for sustainable growth.