As the South African table grape industry moves past the midpoint of the 2026 season, the data released by the Joint Grape Marketing Forum (JGMF) on 15 January paints a picture of a sector performing at peak biological capacity, yet facing significant systemic friction. With all five production regions now actively packing, the industry is grappling with a paradox: a harvest that is ripening faster and more abundantly than last year, but an export pipeline that is significantly constricted.

A Season of High Velocity

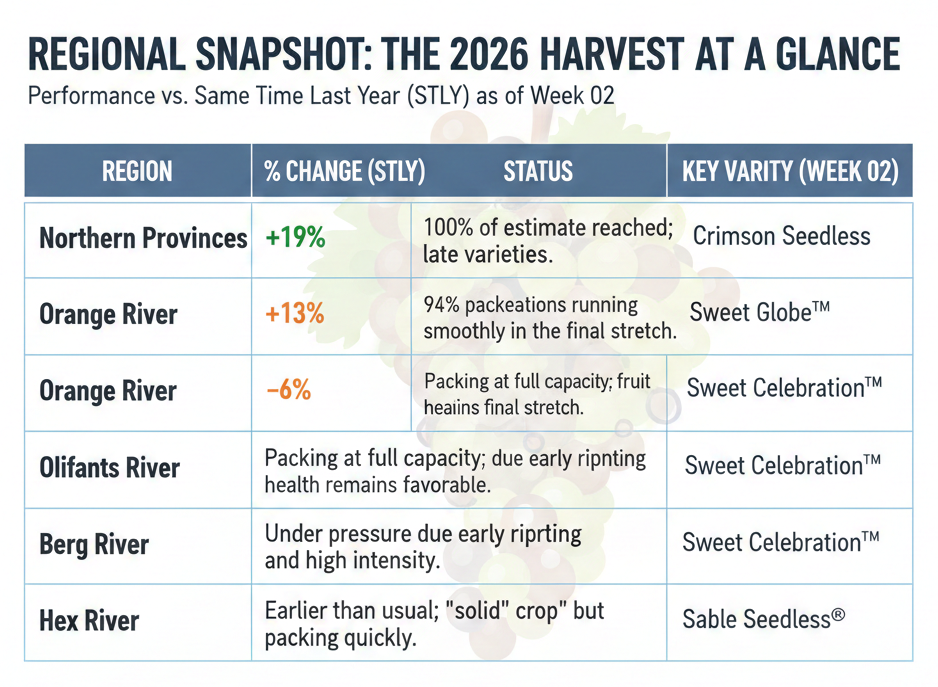

The defining characteristic of the 2026 season is its sheer pace. By Week 02, national inspection volumes reached 38.65 million cartons, a staggering 19% increase over the previous year. This surge is driven by early ripening in the northern and coastal regions, which has placed immense pressure on packhouse capacity.

In the Hex River, the crop is notably earlier than usual, with volumes up 79% compared to the same period last year. Similarly, the Berg River is up 40%. For producers, this “compressed” season is a double-edged sword: while the fruit quality remains high and uniform, the window to harvest and cool the fruit is narrowing, requiring precision management of labour and cold-chain resources.

The Port Performance Deficit

The most sobering statistic in the SATI report is the growing gap between what has been “inspected” and what has actually “departed.” While inspections are up 19%, exported volumes are down 19% year-on-year. As of Week 02, only 20.25 million cartons had left our shores.

The primary culprit remains the Cape Town Container Terminal (CTCT). Beset by 40 hours of wind delays in a single week and operating at a productivity level of 12 gross crane moves per hour (well below the target of 19), the terminal has become a bottleneck for the Western Cape’s “agricultural gold.” This has led to a significant build-up in cold storage, with over 3.4 million cartons sitting in warehouses awaiting a vessel call.

Strategic Adaptations

Faced with these delays, the industry has demonstrated remarkable resilience through diversification. In a massive shift from traditional logistics, only 55% of exports have moved through Cape Town this season, compared to 82% last year. Eastern Cape ports have stepped into the breach, now accounting for nearly 30% of total export volumes.

While these diversions maintain the flow of fruit to the UK and EU—which remain our primary markets—they come at a cost. The increased inland transport to the Eastern Cape erodes grower margins at a time when input costs are already under pressure.

Market Outlook

Despite the logistics hurdles, the demand side remains robust. In the UK, table grapes maintain high household penetration (83%). Interestingly, the gap between red and white varieties is closing, and the market shows a growing willingness to pay for premium, high-quality fruit.

As we look toward the final weeks of the season, the national crop estimate remains steady at 79.4 million cartons. The success of the 2026 season will now depend entirely on whether the intensified oversight and additional resources deployed to the Port of Cape Town can clear the backlog before the late-season cultivars peak.